The 2025 Bender Market Outlook

Contributing authors: Reggie Kuipers, SIOR; Nick Gustafson, CCIM; Bradyn Neises, SIOR; Rob Kurtenbach; Andi Anderson, SIOR; Rob Fagnan; and Alex Soundy, SIOR.

On February 25, Bender Commercial Real Estate Services hosted their annual Market Outlook presentation, diving into the local economic landscape and exploring key sectors within the commercial real estate market. Here’s a recap of the insights they shared:

Economic Overview

One year ago, we expected a tenuous year, but the election, rate cuts, and worldwide geo-political issues may have just been the appetizer for 2025. This year has already experienced disruption from Trump policy, tariffs, forthcoming tax legislation, and an ever-watchful eye on the Fed as they have stalled rate cuts.

The underlying U.S. economy appears robust and last mile inflation incredibly sticky. With pro-business White House and Trump policies putting upward pressure on inflation, 2025 is set up to be a turbulent year. We can expect short-term pain for long-term gain.

The Sioux Falls economy is chugging along as we continue to grow up as a city. Sioux Falls is becoming a metro area, growing into surrounding communities over the next five to ten years. We have a glut of large office spaces and apartments to backfill, but other sectors are healthy. With our population growing at a strong clip, we expect the apartments to backfill fairly quickly. We also predict that 2025 will be the second highest year of building permits in Sioux Falls history.

Capital Markets

Investment sales volume in global, national and local markets remains under the records set in 2021 but has turned the corner and is rebounding nicely. Interest rates and global trade uncertainty continue to be restraining inputs. Inflation has proven stubborn, mainly due to the massive increase in the M2 money supply over the last four to five years. It increasingly appears that interest rates will remain static for the foreseeable future.

Investors are generally well-capitalized and sitting on substantial cash. Sellers are adjusting to new valuations, and we predict robust transactions in 2025. Storm clouds on the horizon are federal issuance of Treasury bonds and potential global trade disruptions.

Land Market

The 2024 Sioux Falls metro land market remained strong, although shifting trends highlight new challenges and opportunities. We saw increased land purchases in neighboring communities due to Sioux Falls development constraints, a trend expected to continue. In response, the City of Sioux Falls is working on greater flexibility in development opportunities and pushing for more infrastructure investment to support growth.

Unimproved land sales reflect this shift as developers seek opportunities in Sioux Falls’ neighboring communities. Improved land sales had a solid year, with office and multi-family transactions increasing, retail land sales holding steady, and industrial land sales down. The industrial sector’s slowdown isn’t due to lack of demand but rather a lack of available options, signaling the need for additional land supply.

Despite these adjustments, confidence in the market remains high. Sioux Falls and its surrounding communities continue to attract investment. With proactive planning and infrastructure improvements, the region is well-positioned for sustained growth in 2025 and beyond.

Retail Market

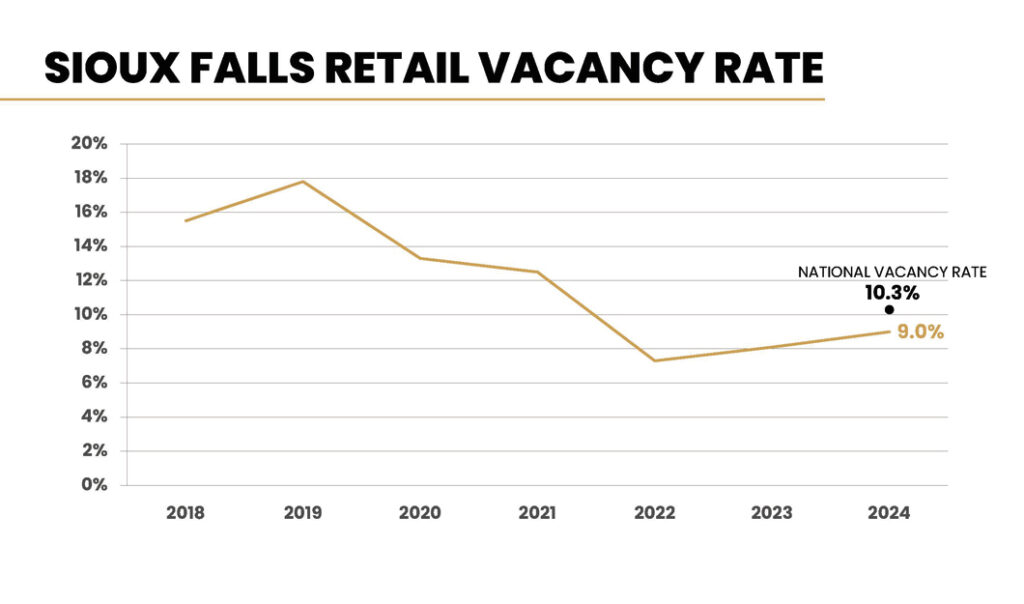

The local retail market remains strong. Sioux Falls maintained lower vacancy rates than the national average and experienced a significant increase in property sales compared to last year.

Nationally, the retail landscape presents a mixed picture. On the one hand, there have been waves of store closure announcements with the potential for more on the horizon. On the other hand, several national retailers continue to thrive and push forward with expansion plans and new locations.

Meanwhile, online retail continues to capture a growing share of the market, a trend that shows no signs of slowing down.

Office Market

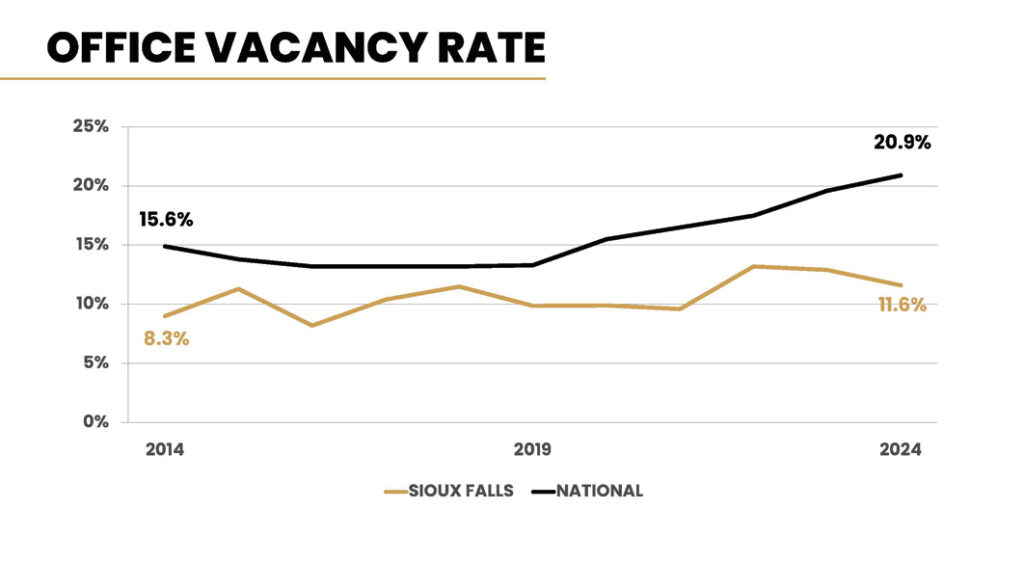

The office market has been the sector most affected by pandemic. We see that reflected in the national office market with a record-high 20.9% vacancy rate in 2024. Last year also brought positive net absorption nationally, meaning more space is being leased than vacated. We see demand returning to pre-pandemic levels.

The Sioux Falls office vacancy rate of 11.6% continues to be lower than the national rate. The gap between the national and local rate also continues to widen, highlighting the challenges we see nationally.

Sioux Falls is still experiencing high amounts of office vacancy with 1.1 million square feet available. Of that, more than 800,000 square feet is in buildings 10,000 square feet and larger: more than 75% of the vacant square footage.

For 2025, we expect some exciting announcements and are looking forward to opportunities and growth in the office market.

Industrial Market

The industrial sector is closely watching the impact of tariffs on manufacturing, transportation, warehousing, and product distribution across the U.S.

While it’s still too early to determine their full effect, we will monitor this closely over the next few years.

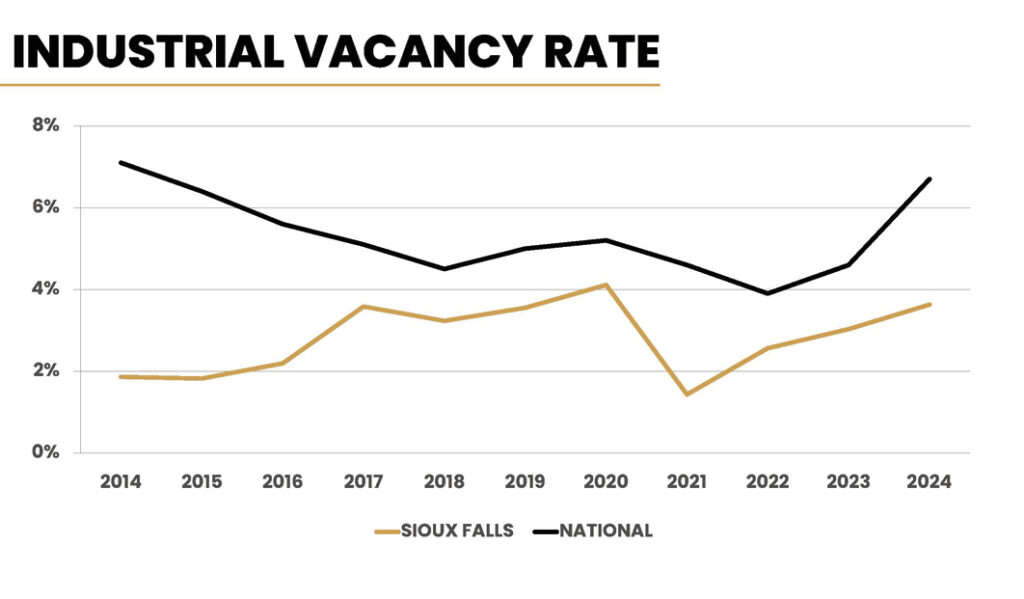

Nationally, the industrial market weakened, with vacancy rates reaching a 10-year high of 6% by the end of 2024 Accompanied by negative net absorption, this put downward pressure on rental rates.

Locally, the market has shown mixed signals. Vacancy rates edged up to 3.7% by the end of 2024, while new construction and absorption remained strong. This was largely driven by owner-occupier sales, which totaled $110 million. Lease rates continued rising, influenced by inflationary construction costs. Looking ahead, 2025 appears promising, with numerous projects already underway.

Multi-Family Market

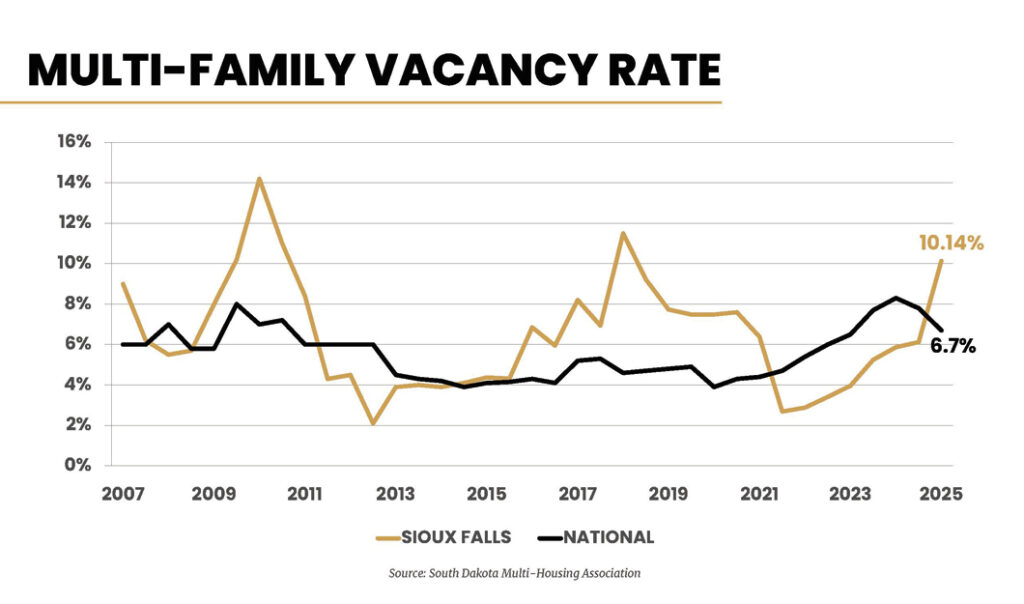

After two record-setting years, Sioux Falls’ multi-family market experienced a significant downward shift in 2024 with permits down to 1,244 units. Conventional vacancy rates rose to 10.14%, with true vacancy rates closer to 14.33% when factoring in lease-up units. Rent growth remained flat as higher vacancy rates led to increased concessions—such as free rent and move-in incentives —providing renters with short-term opportunities.

Despite financing challenges, Sioux Falls saw $87 million in multi-family sales across 22 transactions. Three large, all-cash REIT purchases totaling just over $60 million in sales signal strong institutional confidence in the market’s future.

Looking ahead to 2025, there are two key drivers for multi-family sales: the rising cost of homeownership will increase investor confidence and upcoming loan maturities will create opportunities to capitalize on distressed assets.

As vacancy rates stabilize and demand continues to grow, Sioux Falls remains a dynamic and resilient market. With strong long-term fundamentals and a thriving economy, the city continues to be an attractive destination for multi-family investors.

Bender Commercial’s team of trusted advisors provides services in the leasing and sales of office, retail, industrial, land and investment properties. You can visit benderco.com/research to see the full Market Outlook 2025 presentation and slides.