The 2024 Market Outlook

Contributing authors: Reggie Kuipers, SIOR; Nick Gustafson, CCIM; Bradyn Neises, SIOR; Andi Anderson, SIOR; Rob Kurtenbach; Rob Fagnan; and Alex Soundy, SIOR.

As the year 2024 unfolds, Sioux Falls stands at the intersection of local economic dynamic forces and national trends within the commercial real estate market. Bender Commercial hosted their 2024 Market Outlook on Feb. 22. The presentation dove into the local economic landscape and explored key sectors within the commercial real estate market. Here’s a recap of insights shared.

Economic Overview

The Sioux Falls commercial real estate market should expect solid activity and a modest tailwind in 2024. The fact is there are a lot of outside factors coming into play this year, such as the Presidential election, presumed fed funds rate cuts, geo-political issues, employment and more. Credit has tightened as banks went from being saturated with deposits to now relying on borrowing from the Fed or paying the consumer 4-5.5% for CD’s and money market accounts. We do expect inflation to be sticky and have tempered expectations (we believe 50-75 basis points) on the Fed cutting rates as much as the prognosticators anticipate (75-125 basis points). Despite these factors, we anticipate another solid year and Sioux Falls is poised to continue to push forward with large projects and more announcements. We are all blessed to do business in this community!

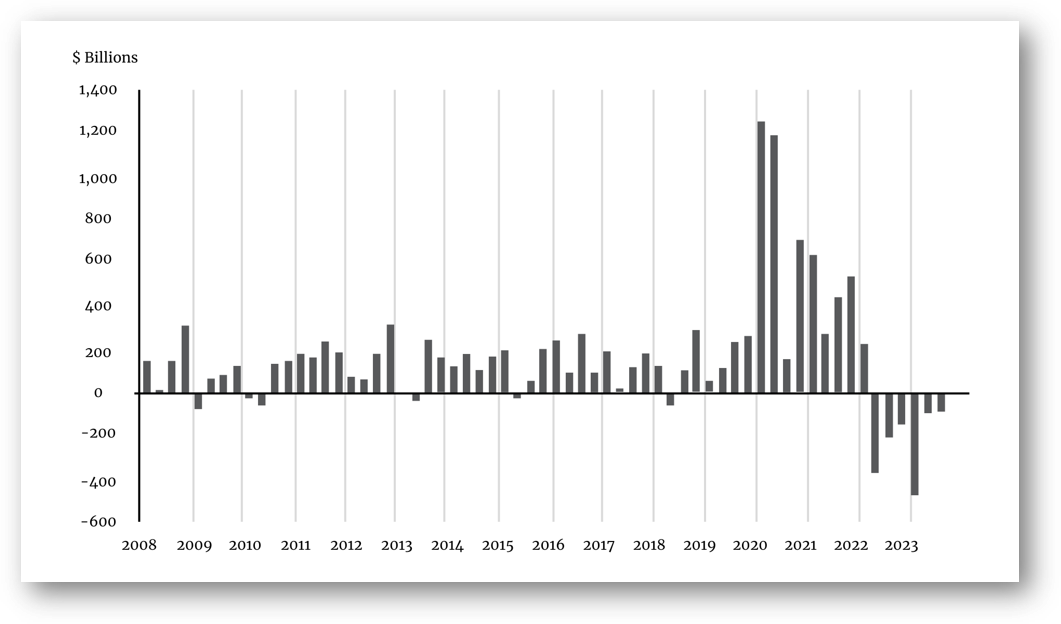

Capital Markets

National and local real estate investment markets experienced a significant drop in transactions volume from 2022 to 2023. This sharp pullback was due to exponentially (and historic) rising costs of debt colliding with high seller expectations on value and low motivation levels. National and local economies remain robust, and investors are sitting on record levels on cash collecting healthy risk-free yields. We expect transactions levels in 2024 to have a modest increase over 2023 sales volume due to shifting seller expectations. Transactions that will occur this year will be driven by seller profit taking and refinancing avoidance at higher debt costs. The pullback in transactions is a healthy reset versus a liquidity or credit crisis. Local and regional lenders will lend conservatively in 2024 as deposits chase money market yields and bankers quote borrowing costs based on high federal funds rates plus a profit/safety delta. Buyers, sellers and bankers will watch the Federal Reserve closely all year.

Land Market

The Sioux Falls metro land market shows signs of slowed development from a historic high in Sioux Falls area. Despite the lower numbers there are still signs of confidence in our metro area. The unimproved land market was down slightly but shows continued interest from developers in the growth of our communities. A trend that may be emerging is developers looking closer at opportunities in our neighboring communities with opportunities getting harder to find in Sioux Falls. Improved land sales were on pace from the previous years. Retail sales are the steady performer with convenience stores being a large contributor to those sales. Industrial sales are down, but not for a lack of demand. The past few years we have had record sales of industrial land, which has absorbed a large majority of the supply. We expect private developers and community economic development groups to add more supply into our industrial land market and take advantage of the imbalance in the market. All in all, the land market in 2023 has shown that there is confidence in investing in our community and in 2024 we are likely to see the same confidence in our Sioux Falls metro.

Office

The national and local office market has been experiencing some challenges over the past several years. There are large blocks of office space sitting vacant that were built in the 80s and 90s. These pose a challenge since to retrofit or renovate these properties is very expensive. Between the low ceiling heights and aged buildouts, owners will need to get very real with their pricing structure to attract buyers. It will be interesting to continue to watch the work environment for employees. There continues to be a large number working a hybrid schedule, as well as 13% working fulltime from home. This will be an interesting trend to watch over the next several years as it has certainly changed how employers operate their businesses. Sioux Falls has such a great quality of life that even though people no longer need to work where they live, our community will likely be less impacted by this trend than the national market.

Retail

Retailers continue to explore shrinkflation in more ways than one. In 2023, they hit the lowest average size of new retail leases in the last 20 years. The average new lease footprint is now down to 3,200 square feet, compared to nearly 5,000 square feet during that same period. Are large regional retail centers a thing of the past? Trends are suggesting that retailers and consumers are preferring neighborhood retail centers instead. Locally, Sioux Falls continues to be a strong retail market with vacancies remaining steady at just over 8%.

Industrial

The industrial market nationally is starting to reveal some cracks in the foundation. Sales and new construction starts plummeted in 2023 as a result of higher interest rates and market normalization. However, the greater Sioux Falls industrial market saw some resiliency in 2023 with a slight increase in sales from 2022. New construction, vacancy rates and lease rates have remained stable, which is the cause for continued expansion.

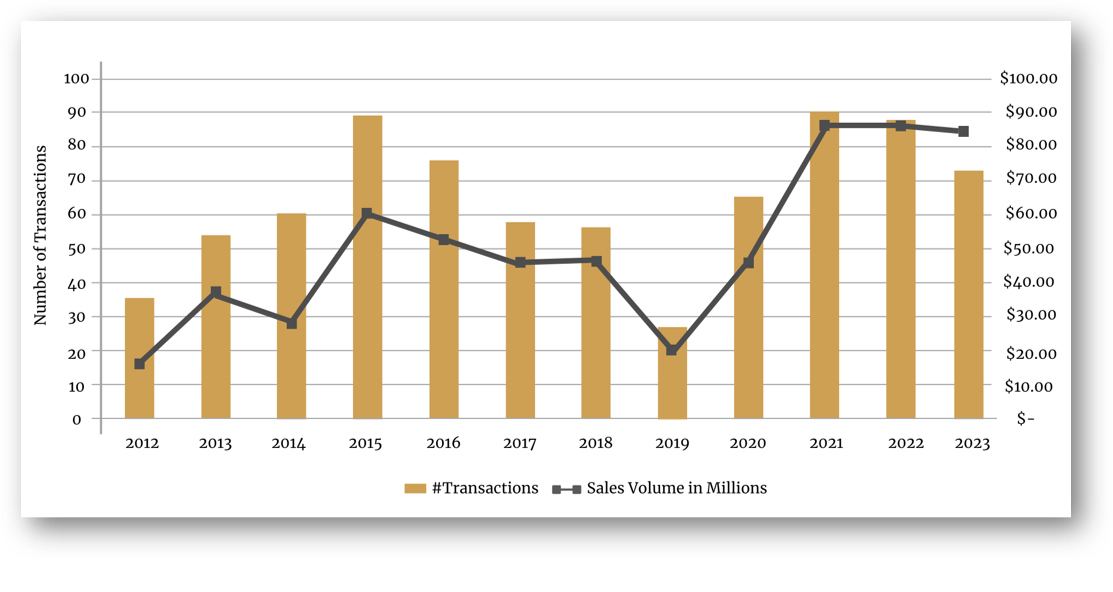

Multi-Family

After a record stretch in multi-family sales transactions (2020-2022), both the national and local multi-family markets saw a pullback in 2023. This pullback was not due to a lack of interest from multi-family investors, but rather a limited number of deals that penciled with current seller expectations on value, higher interest rates, and significant increases in property taxes and insurance premiums. Despite the drop in multi-family sales transactions, both the national and local multi-family markets had a very strong 2023 for new development. With the cost to own remaining significantly higher than the cost to rent, we will continue to see developers bring new units to the market to meet demand. As for 2024, there’s enough buyer demand for a robust year in the multi-family market, but will the deals pencil? All eyes will be on the Federal Reserve in 2024.